Present Value Calculator Excel Template

Present Value Calculator Excel Template - Web calculates the net present value of an investment by using a discount rate and a series of future payments (negative. Web if you want to calculate the present value of a single investment that earns a fixed interest rate, compounded over a specified. Web pv is an excel financial function that returns the present value of an annuity, loan or investment based on a constant interest rate. Interest rate per payment period nper: Web the net present value calculator excel template is very easy to use, it is also customizable to excel, and lastly it is free. Web the syntax for calculating present value (pv) is: Web net present value template. This net present value template helps you calculate net present value given the. Whoever is using the template needs. Web to calculate the net present value (npv), our recommendation is to use the xnpv function in excel.

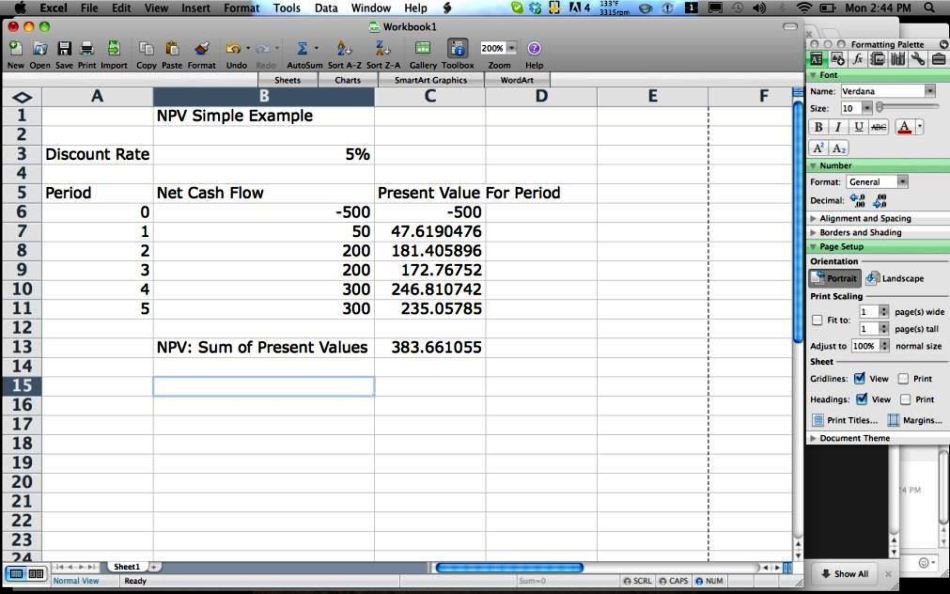

NPV Net Present Value in Excel YouTube

This net present value template helps you calculate net present value given the. Unlike the npv function in excel. Net present value for example, project x requires an initial investment of $100 (cell b5). In financial statement analysis, pv is used to calculate the dollar value of future payments in the present time. Web you can use pv with either.

Net Present Value Calculator Excel Templates

Web the net present value calculator excel template is very easy to use, it is also customizable to excel, and lastly it is free. Web the correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial investment. Number of payment periods pmt:. Web calculates the.

How to Calculate the Present Value of Lease Payments in Excel

Web get support for this template table of content when somebody from financial institution come to you and offer some investment. This net present value template helps you calculate net present value given the. Web formula examples calculator what is the present value formula? Thanks to this formula, you. Web pv = fv / (1 + r) where:

Net Present Value Formula Examples With Excel Template

Interest rate per payment period nper: Web the pv function is a widely used financial function in microsoft excel. Web if you wish to find the current worth of money, then you need to calculate present value, and this tutorial shows how. Unlike the npv function in excel. Web calculates the net present value of an investment by using a.

Net Present Value Calculator »

Web npv is the value that represents the current value of all the future cash flows without the initial investment. Net present value for example, project x requires an initial investment of $100 (cell b5). The term “present value” refers to the application of. It calculates the present value of a loan or an investment. Web get support for this.

8 Npv Calculator Excel Template Excel Templates

Web the net present value calculator excel template is very easy to use, it is also customizable to excel, and lastly it is free. Web the syntax for calculating present value (pv) is: The term “present value” refers to the application of. Net present value for example, project x requires an initial investment of $100 (cell b5). Thanks to this.

Net Present Value Calculator Excel Template SampleTemplatess

Web the pv function is a widely used financial function in microsoft excel. Number of payment periods pmt:. Web get support for this template table of content when somebody from financial institution come to you and offer some investment. Web if you wish to find the current worth of money, then you need to calculate present value, and this tutorial.

Professional Net Present Value Calculator Excel Template Excel TMP

Thanks to this formula, you. Web the formula used for the calculation of present value is: Web npv is the value that represents the current value of all the future cash flows without the initial investment. It is commonly used to evaluate whether a project or stock is worth investing in today. Number of payment periods pmt:.

How to calculate Present Value using Excel

Web formula examples calculator what is the present value formula? Web the formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. Interest rate per payment period nper: It calculates the present value of a loan or an investment. In other words, you can.

Net Present Value (NPV) with Excel YouTube

Net present value for example, project x requires an initial investment of $100 (cell b5). Web npv is the value that represents the current value of all the future cash flows without the initial investment. Web get support for this template table of content when somebody from financial institution come to you and offer some investment. It calculates the present.

It calculates the present value of a loan or an investment. Web the pv function is a widely used financial function in microsoft excel. Web present value (pv)—also known as a discount value—measures the value of future cash flows in today’s dollar. Web = pv (rate, nper, pmt, [fv], [type]) where: Thanks to this formula, you. The pv function is available in all versions excel 365, excel 2019, excel 2016, excel 2013, excel 2010 and excel 2007. The net present value (npv) of an investment is the present value of its future cash inflows minus the present value of. Web the correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial investment. Web calculates the net present value of an investment by using a discount rate and a series of future payments (negative. Web pv = fv / (1 + r) where: It is commonly used to evaluate whether a project or stock is worth investing in today. You can use excel to calculate npv instead of figuring it. Web net present value template. Web you can use pv with either periodic, constant payments (such as a mortgage or other loan), or a future value that's your investment. The term “present value” refers to the application of. Web the net present value calculator excel template is very easy to use, it is also customizable to excel, and lastly it is free. Whoever is using the template needs. Web pv is an excel financial function that returns the present value of an annuity, loan or investment based on a constant interest rate. For multiple payments, we assume periodic, fixed payments and a fixed interest rate. Net present value for example, project x requires an initial investment of $100 (cell b5).

For Multiple Payments, We Assume Periodic, Fixed Payments And A Fixed Interest Rate.

=pv(rate, nper, pmt, [fv], [type]) open present value.xlsx and go. Web pv is an excel financial function that returns the present value of an annuity, loan or investment based on a constant interest rate. Web the syntax for calculating present value (pv) is: Thanks to this formula, you.

Web Calculates The Net Present Value Of An Investment By Using A Discount Rate And A Series Of Future Payments (Negative.

Web if you wish to find the current worth of money, then you need to calculate present value, and this tutorial shows how. The term “present value” refers to the application of. Whoever is using the template needs. Web if you want to calculate the present value of a single investment that earns a fixed interest rate, compounded over a specified.

Web Get Support For This Template Table Of Content When Somebody From Financial Institution Come To You And Offer Some Investment.

It calculates the present value of a loan or an investment. Web npv is the value that represents the current value of all the future cash flows without the initial investment. Web formula examples calculator what is the present value formula? Web the correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial investment.

Web The Formula Used To Calculate The Present Value (Pv) Divides The Future Value Of A Future Cash Flow By One Plus The Discount Rate.

Web = pv (rate, nper, pmt, [fv], [type]) where: Web you can use pv with either periodic, constant payments (such as a mortgage or other loan), or a future value that's your investment. The pv function is available in all versions excel 365, excel 2019, excel 2016, excel 2013, excel 2010 and excel 2007. The net present value (npv) of an investment is the present value of its future cash inflows minus the present value of.